Radioligand Therapy’s Rise: Precision‑Targeted Isotopes Transforming Oncology with Novel Pipeline & Infrastructure Surge

Radioligand therapy is emerging as a precision oncology pillar-fast-growing market, robust pipeline across cancer types, challenges, expansion via AI & M&A

AUSTIN, TX, UNITED STATES, June 24, 2025 /EINPresswire.com/ -- 1. Scientific Principles & Therapeutic Mechanism

RLT employs radioisotopes affixed to tumor-targeting ligands, enabling the delivery of lethal radiation (alpha or beta particles) directly to cancer cells while sparing healthy tissue. Common isotopes include lutetium-177, actinium-225, gallium-68 (diagnostic), fluorine-18, and radium-223. The therapy combines isotopic radiance with molecular targeting-e.g., PSMA in prostate cancer or somatostatin receptors in neuroendocrine tumors. Labeled ligands bind to specific antigens, internalize into malignant cells, and deliver DNA-damaging radiation. Alpha particles offer high linear energy transfer (LET) with minimal tissue penetration, enhancing precision.

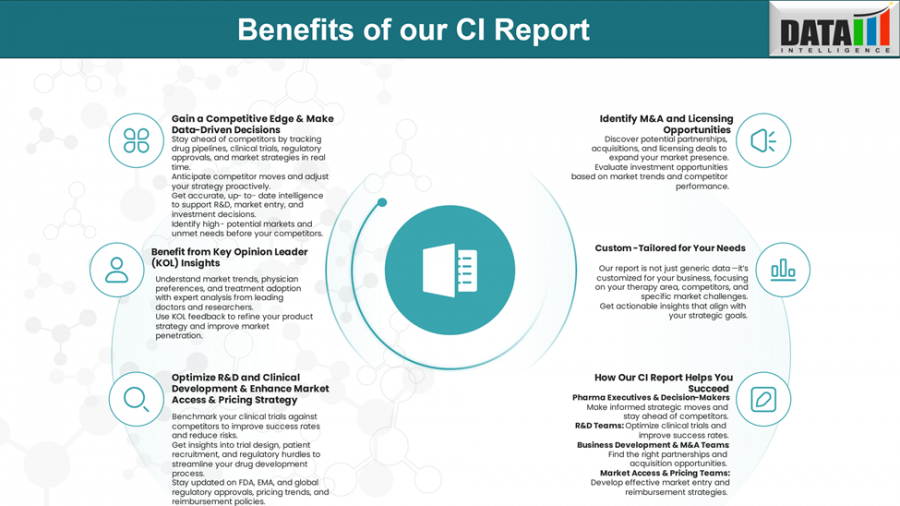

Download CI Sample Report: https://www.datamintelligence.com/strategic-insights/ci/radioligand-therapy-rlt

2. Market Evolution & Forecast

The RLT market was estimated at USD 7–8 billion in 2024 and is projected to grow to USD 13–14 billion by 2030–2031, reflecting a 5–9% CAGR.

Growth is driven by:

- Rising incidence of prostate cancer and neuroendocrine tumors

- Maturing pipeline with approvals in multiple oncology indications

- Expansion of both therapeutic isotopes and diagnostic companion agents

North America leads adoption, supported by regulatory and healthcare investment. Asia–Pacific is the fastest-growing region due to expanding nuclear medicine infrastructure and cancer burden. Europe shows solid gains as government programs endorse nuclear oncology.

3. Technological & Clinical Advancements

- Alpha therapies (225Ac, 212Pb): Deliver high-energy, short-range radiation with reduced off-target damage. Supply bottlenecks for actinium-225 remain a key challenge.

- Beta therapies (177Lu): Widely adopted; lutetium-177 labeled agents like PSMA-617 (Pluvicto) and dotatate (Lutathera) have demonstrated strong clinical outcomes and blockbuster potential.

- Dosimetry and AI-enabled theranostics: Advanced imaging, quantitative dose modelling, and personalized treatment planning are emerging as standard-of-care technologies.

- Innovative delivery platforms: Automated manufacturing systems, relocatable clinics, and isotope-supply integration are lowering logistical complexity and enhancing patient access.

4. Leading Pipeline & Approvals

- PSMA-617 (Pluvicto): Approved for metastatic castration-resistant prostate cancer (mCRPC); expanded label in early 2025.

- Lutetium dotatate (Lutathera): Approved for neuroendocrine tumors; generated ~USD 450 million through early 2023, aiming for ~$1 billion in peak sales.

- 225Ac-PSMA-617: Alpha-emitter candidate showing high PSA response rates; early toxicities (e.g., salivary gland and hematologic adverse effects) are driving refined dosing strategies.

- 225Ac-PSMA-R2: In Phase I/II development, targeting both hormone-sensitive and castration-resistant prostate cancer.

- 177Lu-NeoB: Beta-labeled GRPR-targeted agent in trials for breast, prostate, GIST, and glioblastoma.

Ask for Customized CI Sample Report as per Your Business Requirement: https://www.datamintelligence.com/strategic-insights/ci/radioligand-therapy-rlt

5. Expansion of Industry Activity

Acquisitions & Alliances

- Novartis acquired Mariana Oncology to deepen its RLT pipeline beyond Pluvicto and Lutathera.

- Eli Lilly purchased POINT Biopharma (PNT2002, PSMA-targeted) and invested in actinium-225 producers to secure upstream supply.

- AstraZeneca acquired Fusion Pharmaceuticals to enhance access to alpha-based therapeutics and isotope manufacturing.

Integrated Supply Model

- Acquiring control of isotope production-through ties with suppliers like OranoMed, Ionetix, and on-site cyclotron facilities-reduces supply disruptions.

- Centralized manufacturing and mobile radiopharmacies are being implemented to service larger geographic regions.

6. Strategic Obstacles & Operational Constraints

- Isotope scarcity: Actinium-225 production remains limited, prompting interest in alternative isotopes like lead-212 and focusing on supply chain vertical integration.

- High cost structure: Radiopharmaceutical production and cold-chain logistics result in steep treatment costs and reimbursement complexities.

- Regulatory complexity: Treatments require coordination across pharmaceutical and nuclear regulatory bodies, complicating global approvals.

- Workforce readiness: RLT administration needs trained nuclear medicine clinicians and infrastructure, which remain a bottleneck in many regions.

7. Competitive Landscape: Key Players and Strategic Roles

- Novartis: Market leader with Pluvicto, Lutathera, ongoing expansion in isotope production, and diverse pipeline.

- Eli Lilly / POINT Biopharma: Strengthened by PNT2002 and upstream actinium-225 investment-building an end-to-end radioligand strategy.

- AstraZeneca / Fusion: Entered RLT with alpha-emitter capabilities and manufacturing assets.

- Sanofi / OranoMed: Partnering to develop lead-212-based therapies for neuroendocrine oncology, with in-house isotope production.

- Curium, Bayer, Telix, Lantheus, OranoMed: Offer SPECT/PET diagnostics and therapeutic isotopes-positioned for both organic and inorganic growth.

- Emerging biotech: Focused on novel ligands, AI-driven dosimetry, and conjugates targeting alternate receptors (e.g., GRPR, EGFR).

Book Free CI Consultation Report: https://www.datamintelligence.com/strategic-insights/ci/radioligand-therapy-rlt

8. Strategic Imperatives for Pharma Executives

- Secure isotope supply: Acquire or partner upstream with isotope producers to buffer against shortages and support alpha therapy scale-up.

- Enhance therapeutic diversity: Expand indications beyond prostate and neuroendocrine cancers, including breast, lymphoma, and cardiology.

- Invest in theranostic infrastructure: Deploy AI-enabled dosimetry systems, mobile treatment units, and decentralized manufacturing for regional market access.

- Engage regulators early: Align with dual pharma/nuclear frameworks for RLT approval and define long-term safety and dosimetry standards.

- Design payer-aligned evidence packages: Demonstrate improved survival, precision dosing, and lower ancillary care costs to justify reimbursement.

- Workforce development: Support training for nuclear medicine teams and equip oncology networks for RLT protocols.

- Logistics proficiency: Build cold-chain distribution and mobile pharmacy models to service remote oncology centers.

Read Related CI Reports:

1. chronic alopecia areata | Competitive Intelligence

2. Autosomal Dominant Polycystic Kidney Disease | Competitive Intelligence

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release