Veterinary Microchips Market to Hit US$ 1.95 Billion by 2034 Amid Rising Pet Adoption

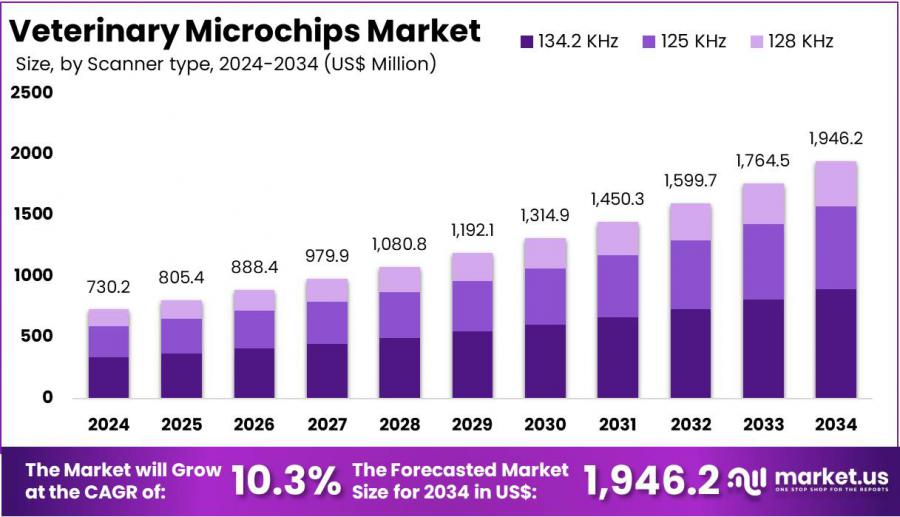

Veterinary Microchips Market Size is expected to reach US$ 1946.2 Mn by 2034, from US$ 730.2 Mn in 2024, growing at a CAGR of 10.3%.

NEW YORK, NY, UNITED STATES, February 24, 2025 /EINPresswire.com/ -- The Global Veterinary Microchips Market is projected to grow significantly, reaching US$ 1.95 billion by 2034, up from US$ 730.2 million in 2024. This expansion represents a CAGR of 10.3% from 2025 to 2034. The demand for microchips is increasing due to their effectiveness in pet identification and the growing number of pet adoptions worldwide. As more pet owners seek secure and permanent identification methods, the adoption of veterinary microchips is rising. These tiny implants provide essential identification details, significantly increasing the chances of reuniting lost pets with their owners. Studies show that microchipped dogs have a 52% return rate, while non-microchipped dogs have only a 22% return rate. Similarly, microchipped cats have a 38% return rate, compared to 2% for non-microchipped cats.

Government regulations are playing a crucial role in market growth. Many countries have mandated pet microchipping, making it compulsory for pet owners. These laws ensure that pets are easily identifiable, reducing the burden on animal shelters and improving pet recovery rates. Regulatory initiatives in Europe, the U.S., and parts of Asia are pushing microchip adoption. Such legal requirements drive higher demand for veterinary microchips, as pet owners comply with regulations to avoid fines and ensure their pets' safety. This enforcement increases awareness and encourages responsible pet ownership, further fueling market growth.

Advancements in microchip technology are also contributing to industry expansion. Modern microchips now come with enhanced data storage, integration capabilities, and improved tracking features. These upgrades allow veterinarians to store medical history, vaccination records, and owner details within the chip. Some microchips are even compatible with smartphone apps, enabling pet owners to access their pets’ medical history conveniently. These technological enhancements increase the utility of microchips, making them more attractive to both veterinarians and pet owners. The continuous evolution of microchip functionalities ensures sustained demand in the coming years.

The rise of veterinary telemedicine has further boosted microchip adoption. Telemedicine relies on accurate pet identification to access digital medical records and streamline remote consultations. With the integration of microchip data into telehealth platforms, veterinary professionals can quickly retrieve a pet’s health history, leading to faster and more effective diagnoses. This seamless access to data makes microchips an essential tool in modern veterinary care, strengthening their importance beyond identification. The growing adoption of digital healthcare solutions in veterinary services will continue to support the microchip market.

The veterinary microchip market is set for strong growth, driven by higher adoption rates, supportive legislation, technological advancements, and expanding telemedicine applications. As pet ownership rises and regulations become stricter, the demand for microchips will surge. Innovations in microchip features will further enhance their appeal, ensuring a sustained growth trajectory through 2034.

KEY TAKEAWAYS

• The global non-invasive aesthetic treatments market was valued at USD 730.2 million in 2024 and is projected to reach USD 1,946.2 million by 2034, growing at 10.3% CAGR.

• In 2024, the dogs segment dominated the global market, accounting for 28% of the total revenue share, highlighting strong demand for pet-related aesthetic treatments.

• The 134.2 KHz segment secured 46% of the total revenue share, making it the leading frequency choice in the global non-invasive aesthetic treatments market.

• Veterinary hospitals and clinics dominated the market in 2024, contributing 87% of the total revenue, emphasizing their critical role in administering aesthetic treatments.

• North America led the global market with a 33.2% revenue share, maintaining its position as the dominant region for non-invasive aesthetic treatments.

Get Sample PDF Report: https://market.us/report/veterinary-microchips-market/request-sample/

COMPREHENSIVE ANALYSIS

The primary goal of this report is to deliver factual, actionable data about the Veterinary Microchips market. It equips readers with the necessary information to formulate and execute informed strategies based on the extensive data provided. The report includes detailed market statistics that offer insights into the current market status, future projections, and classifications based on various criteria such as product type, end-use, and region.

The report thoroughly covers the classification of the Veterinary Microchips market, highlighting significant aspects like product types and the main industries associated with the Veterinary Microchips Market. It also delves into critical industry dynamics such as development trends, supply, and demand conditions. This analysis provides a deep understanding of the market's current landscape and growth trajectory over the years.

Furthermore, the report extensively analyzes business plans, sales, and profitability to enhance readers' understanding of the Veterinary Microchips market. It discusses essential elements like production volumes, sales data, key raw material suppliers, and buyers in the industry. These details are crucial for understanding the informational needs and distribution rates within the market.

MARKET INSIGHT AND COMPETITIVE OUTLOOK

The Competitive Landscape section of the Veterinary Microchips market report meticulously examines the dominant players shaping the industry. This analysis underscores the strategic initiatives and relentless efforts these firms undertake to secure competitive advantages. Through detailed evaluations, the section offers insights into the strategies deployed by these key influencers, enhancing stakeholders' understanding of the market dynamics.

This segment features comprehensive profiles of each leading company, providing essential details such as company history, business focus, and market position. These profiles help readers visualize the major forces sculpting the market landscape, offering a snapshot of each entity's influence and strategic direction.

The report also delves into company overviews and financial highlights, presenting a clear picture of the economic health and investment priorities of these entities. This financial analysis is crucial for stakeholders, as it elucidates the funding dynamics and revenue streams that drive these companies toward market leadership.

Furthermore, the section elaborates on product portfolios, SWOT analyses, key strategies, and developments. This compilation not only highlights the strengths, weaknesses, opportunities, and threats each company encounters but also showcases their strategic maneuvers and product innovations. Such comprehensive details provide a well-rounded understanding of their market presence and growth tactics.

The Primary Entities Identified In This Report Are:

• Merck & Co. Inc.

• Peeva Inc.

• Virbac

• ID Tech (Eruditus Executive Education)

• Dipole RFID

• Trovan Ltd.

• Wuxi Fofia Technology Co. Ltd

• Avid Identification Systems Inc.

• Datamars

• Pethealth Inc.

SEGMENTATION PERSPECTIVE

The global veterinary microchips market is segmented based on animal type into dogs, cats, horses, and others. In 2024, the dogs segment dominated the market with a 28% share. This dominance is due to the widespread adoption of dogs as pets and their higher likelihood of getting lost. As dogs are frequently outdoors, they face increased risks of separation from their owners. The demand for effective identification solutions has led to widespread microchipping. Additionally, rising veterinary healthcare costs and regulations on pet identification further drive market growth. The United States leads in pet dog ownership, with 90 million dogs.

By scanner type, the market is divided into 134.2 KHz, 125 KHz, and 128 KHz microchips. The 134.2 KHz scanner type held the largest market share in 2024, capturing 46%. This dominance is due to its global standardization by the International Organization for Standardization (ISO). The widespread use of this frequency ensures compatibility across different regions, enhancing pet tracking and identification. As international regulations favor this standard, adoption continues to rise. The increasing need for reliable pet identification solutions further boosts demand for 134.2 KHz microchips.

The market is also segmented by distribution channels, including veterinary hospitals/clinics and others. Veterinary hospitals and clinics held the largest share in 2024, accounting for 87% of the market. These facilities play a crucial role in pet healthcare and are the primary locations for microchipping. Pet owners trust veterinarians for their pets' safety, driving demand in these settings. Veterinary clinics provide comprehensive pet care, making them key distribution centers. As awareness of lost pet recovery grows, veterinary hospitals and clinics remain the dominant distribution channel.

Key Segments Covered In This Report Are:

By Animal Type

• Dogs

• Cats

• Horses

• Others

By Scanner Type

• 2 KHz

• 125 KHz

• 128 KHz

By Distribution Channel

• Veterinary Hospitals/Clinics

• Others

Buy Directly: https://market.us/purchase-report/?report_id=138550

REGIONAL ANALYSIS

North America leads the global veterinary microchips market due to high pet ownership rates and a strong focus on pet health and safety. Rising per capita income and increasing veterinary treatment costs push pet owners to invest in advanced technologies like microchips. These devices help ensure pet security and health, making them a preferred choice. Additionally, organizations like the North American Pet Health Insurance Association (NAPHIA) promote pet insurance, encouraging microchipping as a standard practice. Strong consumer awareness further strengthens North America’s dominance in the veterinary microchips market.

In 2023, 66% of American families, or 86.9 million households, owned a pet, according to the American Pet Products Association. This growing pet ownership rate drives demand for pet-related services, including microchipping. With increasing concerns about lost pets, microchip adoption is on the rise. Veterinary clinics and animal shelters widely support and promote microchipping. Government regulations in some states also mandate pet microchipping, boosting market growth. These factors contribute to the steady expansion of the veterinary microchips market in North America.

What to Expect in Our Veterinary Microchips Market Report?

1. Market Growth and Industry Dynamics

○ The report examines market drivers, challenges, and opportunities shaping the Veterinary Microchips industry.

○ It identifies key trends influencing industry growth and technological advancements.

2. Regional and Country-Level Market Insights

○ The report provides an in-depth analysis of market share, consumption patterns, and growth potential across key regions.

○ It highlights countries driving industry expansion and emerging market opportunities.

3. Competitive Landscape and Key Players

○ The report analyzes leading market players, their revenue performance, and strategic initiatives.

○ It evaluates competition intensity, highlighting key challenges and market positioning.

4. Mergers, Acquisitions, and Expansion Strategies

○ The study covers major industry mergers, acquisitions, and business expansions shaping the market.

○ It provides insights into market concentration levels and top players' shares.

5. Opportunities for New Market Entrants

○ The report identifies potential market gaps and investment opportunities for new entrants.

○ It examines market entry strategies and factors influencing business success.

6. Strategic Business Expansion Plans

○ It details how companies are expanding their market presence and strengthening their competitive edge.

○ It explores partnerships, collaborations, and technological advancements driving growth.

7. Impact of Competitive Strategies on Market Trends

○ The report assesses how competition influences product innovation and pricing strategies.

○ It evaluates competitive advantages and challenges shaping industry development.

8. Emerging Trends Impacting Future Growth

○ The study highlights innovations, automation, and evolving regulatory landscapes shaping market growth.

○ It forecasts new technological advancements in Veterinary Microchips .

9. Fastest-Growing Product Types and Market Segments

○ The report identifies product categories with the highest projected compound annual growth rate (CAGR).

○ It examines demand trends across different product segments.

10. Dominant Application Segments in the Industry

○ The study outlines key application areas driving demand in the Veterinary Microchips market.

○ It evaluates sector-wise market penetration and revenue contributions.

11. Lucrative Geographical Markets for Manufacturers

○ The report highlights the most profitable regions for manufacturing and market expansion.

○ It provides insights into regional demand, regulatory frameworks, and investment opportunities.

This report provides well-researched conclusions and actionable insights, helping businesses navigate the evolving Veterinary Microchips industry effectively.

*Note: We offer customized market research reports tailored to meet your specific business needs and requirements.

CONCLUSION

The veterinary microchips market is set for strong growth due to rising pet ownership, increasing awareness of pet safety, and strict government regulations. The need for secure and permanent pet identification is driving demand, with microchips becoming an essential tool for pet recovery. Advancements in technology, such as improved data storage and integration with telemedicine, are enhancing their functionality. Veterinary hospitals and clinics remain key distribution channels, ensuring widespread adoption. North America leads the market due to high pet adoption rates and supportive policies. As innovation continues, microchip adoption will rise, providing long-term security for pets and convenience for owners. This steady expansion highlights the market’s promising future.

GET MORE:

• Veterinary vaccines Market: https://market.us/report/veterinary-vaccine-market/

• Veterinary Electrosurgery Market: https://market.us/report/veterinary-electrosurgery-market/

• Veterinary Software Market: https://market.us/report/veterinary-software-market/

• Veterinary Supplements Market: https://market.us/report/veterinary-supplements-market/

• Homeopathic Veterinary Medicines Market: https://market.us/report/homeopathic-veterinary-medicines-market/

• Veterinary Surgical Instruments Market: https://market.us/report/veterinary-surgical-instruments-market/

• Veterinary Medicine Market: https://market.us/report/veterinary-medicine-market/

• Veterinary Reference Laboratory Market: https://market.us/report/veterinary-reference-laboratory-market/

• Veterinary Diagnostic Imaging Market: https://market.us/report/veterinary-diagnostic-imaging-market/

• Veterinary Oncology Market: https://market.us/report/veterinary-oncology-market/

• Veterinary Ventilators Market: https://market.us/report/global-veterinary-ventilators-market/

• Veterinary Lasers Market: https://market.us/report/veterinary-lasers-market/

• Veterinary Blood Lactate Test Meter Equipment Market: https://market.us/report/veterinary-blood-lactate-test-meter-equipment-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release