Non-Oncology Biopharmaceuticals: Chronic Care & Rare Disease Therapies See Major Global Demand | DataM Intelligence

Non-Oncology Biopharmaceuticals Market to hit US$ 313.70B by 2033, driven by rising demand for biologics, biosimilars & gene therapies for rare diseases.

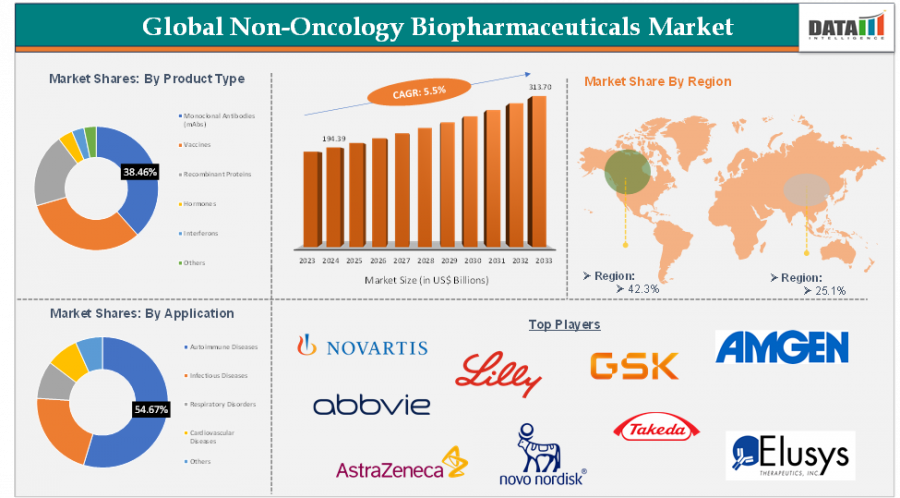

AUSTIN, TX, UNITED STATES, June 18, 2025 /EINPresswire.com/ -- Non-Oncology Biopharmaceuticals Market reached US$ 194.39 Billion in 2024 and is expected to reach US$ 313.70 Billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033.

The demand for non-oncology biopharmaceuticals is surging globally as healthcare systems prioritize treatments for chronic diseases, autoimmune disorders, metabolic conditions, infectious diseases, and rare genetic disorders. Driven by an aging population, improved diagnostic techniques, and innovations in biologics and biosimilars, the market is steadily expanding beyond traditional small-molecule drugs. With advancements in monoclonal antibodies, vaccines, recombinant proteins, and gene therapies, patients now benefit from highly targeted and more effective treatment options.

To Download Sample Report: https://datamintelligence.com/download-sample/non-oncology-biopharmaceuticals-market

Regional Outlook

North America dominates the non-oncology biopharmaceuticals market, contributing nearly half of global revenues. The region’s leadership is reinforced by its robust R&D ecosystem, widespread healthcare access, and a favorable regulatory environment that supports innovative biologics. The U.S. biopharma sector continues to be a global benchmark, driving both revenue and clinical innovation in non-oncology applications.

Europe is also witnessing sustained growth, especially in countries like Germany, France, and the U.K. Biosimilar uptake has been particularly strong across the EU, promoting affordability and access to biologics. Efforts to standardize regulatory frameworks and invest in public health initiatives continue to foster a healthy European biopharma ecosystem.

Asia-Pacific remains the fastest-growing region, spurred by increasing healthcare investment, government policy support, and rapidly evolving manufacturing capabilities. China, Japan, South Korea, and India are emerging as key hubs for both biologics production and clinical trials. Japan, in particular, is investing heavily in revitalizing its drug approval pipeline and building global partnerships.

Latin America, Middle East & Africa represent high-potential emerging markets. As public and private healthcare infrastructures improve and patient demand for innovative treatments grows, these regions are steadily becoming more attractive to biopharma companies seeking new revenue streams.

Major Players

Novartis AG

Eli Lilly and Company

GlaxoSmithKline

Amgen Inc

AbbVie Inc

AstraZeneca

Novo Nordisk A/S

Takeda Pharmaceutical Company Ltd

Elusys Therapeutics

Swedish Orphan Biovitrum

Market Segmentation:

By Product Type: Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, Hormones, Interferons, Others.

By Application: Autoimmune Diseases, Infectious Diseases, Respiratory Disorders, Cardiovascular Diseases, Others.

By Route of Administration: Injectable, Oral, Topical, Nasal, Others.

By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies.

By Region: North America, South America, Europe, Asia Pacific, Middle East, and Africa.

Latest News of USA

The U.S. biopharmaceutical industry is undergoing rapid transformation, particularly in the non-oncology segment. Gene therapy approvals are gaining momentum, with new treatments for rare metabolic and genetic diseases entering the market. Breakthroughs in mRNA technology, pioneered during the COVID-19 pandemic, are being applied to vaccines for infectious diseases and personalized therapeutics.

Leading biopharma companies are reporting record revenues from chronic care divisions. Major firms are ramping up their investments in cardiovascular, respiratory, and metabolic therapies, reflecting the growing global demand for non-oncology biologics. In parallel, AI-driven drug discovery platforms are helping accelerate clinical trials and identify new molecular targets, enabling faster development cycles.

The U.S. market remains the primary driver of innovation and revenue in the global non-oncology biopharmaceuticals space. Companies are also forging strategic partnerships with academic institutions, biotech startups, and global collaborators to maintain competitive advantage.

Latest News of Japan

Japan’s biopharmaceutical sector is showing renewed momentum. After several years of slow new drug approvals, regulatory reforms are beginning to bear fruit. The average approval lag compared to the U.S. is narrowing, and Japanese companies are actively pursuing global clinical trials to accelerate market entry.

Leading Japanese firms are focusing on niche areas such as gene therapies, rare disease biologics, and next-generation vaccines. In addition, Japan’s aging population is driving demand for treatments targeting cardiovascular, metabolic, and neurological disorders.

Collaborations between Japan’s public research institutions and private companies are fostering innovation. New clinical trial programs are emerging, including the use of radiopharmaceuticals and targeted biologics in diagnostic and therapeutic applications. The country is also investing in manufacturing capabilities to support both domestic and international biopharmaceutical demand.

Japan’s increased openness to international collaboration and greater regulatory efficiency are helping position the country as a key player in the global non-oncology biopharma landscape.

Conclusion

The Non-Oncology Biopharmaceuticals Market is entering an exciting growth phase. With the market projected to rise from US$ 194.39 Billion in 2024 to US$ 313.70 Billion by 2033, opportunities abound for companies that innovate, expand global access, and address evolving healthcare needs.

As biologics and biosimilars continue to advance, and as gene therapies unlock new frontiers in personalized medicine, patients worldwide will benefit from more effective treatments for a wide range of chronic and rare diseases. North America and Europe will remain innovation hubs, while Asia-Pacific, led by China and Japan, will become increasingly influential. The next decade will likely see significant breakthroughs that further redefine what is possible in non-oncology biopharmaceutical care.

Looking For A Detailed Full Report? Get it here: https://datamintelligence.com/buy-now-page?report=non-oncology-biopharmaceuticals-market

Stay informed with the latest industry insights-start your subscription now: https://www.datamintelligence.com/reports-subscription

Related Reports:

Biopharmaceutical Tubing Market

Biopharmaceutical Fermentation Systems Market

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release